The Town of Smithtown Town Board voted unanimously to expand a partial real property tax exemption for senior citizens living on a limited income. The amendment, passed during the February 16th, 2023 Town Board meeting, removed outdated information and increased the amount of the maximum income of a person entitled to the exemption to as much as $58,400 as of July 1, 2022. Notice of the updated partial real property tax exemption was sent via mail to potentially eligible homeowners.

“Our hope is that this change will provide relief to our seniors, so that they may enjoy retirement without undue stress. Times have been especially tough for our senior residents living on a fixed income. The pandemic, the cost of inflation, oil and gas have all inevitably resulted in unforeseen expenses, which can make living on a fixed income especially difficult for seniors. Increasing the maximum income to as high as $58,400, so that residents over the age of 65 can take advantage of the partial tax exemption, can help to alleviate some of this burden.” -Supervisor Ed Wehrheim

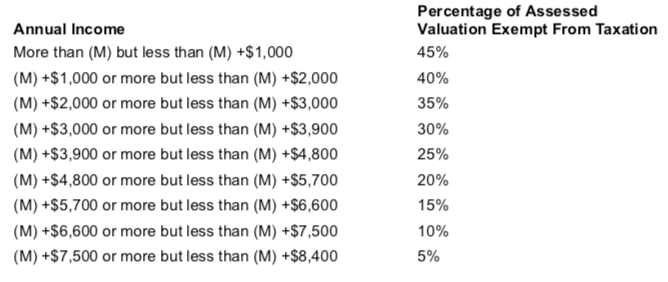

Senior residents, over the age of 65, making an annual income of no more than $58,400 (beginning as of July 1, 2022) are eligible to apply for the partial tax exemption. Thereafter at the percentage of assessed valuation thereof as determined by the following schedule, with the amount for each year represented as (M), pursuant to the provisions of § 467 of the Real Property Tax Law. (M) equals $50,000.

Once granted, the property tax partial exemption can not be rescinded solely due to the death of the older spouse, provided that the surviving spouse is at least 62 years of age.