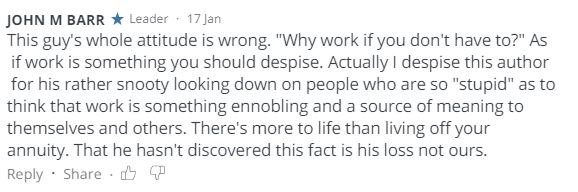

Fig 1: Suze Orman’s opinion of our lifestyle, as captured in a crazy interview on Paula Pant’s Afford Anything podcast.

In case you hadn’t already noticed it in the news, it seems we are hitting a turning point in how the rest of the world perceives this lifestyle that you and I have been enjoying.

First, we were ignored. Then, there were a few stories that just focused on the strange lives of Mr. Money Mustache a few other freaky magicians, cataloging our feats of extreme frugality like “spending less than 100% of your money on a car” or “occasionally eating food from one’s own kitchen.”

But time went by, and our numbers kept growing. And we weren’t just thirtysomething white male tech workers anymore, we were women and men of all ages and professions in all different countries, absorbing blogs and podcasts from a thousand different sources.

Vicki Robin, author of Your Money Or Your Life came out of retirement to write a new edition of her foundational book on the subject of financial independence* and some prominent filmmakers have spent the past year making a documentary called Playing with FIRE about all of this too.

And suddenly, instead of just a blogger or a few millennials here and there, the media is starting to call it the Financial Independence Movement. And this is a big deal, because when it comes to cultural traditions, perception pretty much defines reality.

But when you look it up by Googling the FIRE Movement, you still get a pretty mixed bag of arguments.

The New York Times article looks very positive. But there’s another one in there called “Why I Hate the FIRE Movement”, another that complains our ideas are a “Massive fallacy of composition”, and any number of others saying that we have got one aspect or another wrong.

There’s a tricky paradox going on here: the more people you reach, the bigger the range of misconceptions that will come up, potentially cockblocking your movement before it really takes off.

So, with that in mind, let’s clean up the biggest bits of WRONG that are preventing the latest round of several million new arrivals from fully enjoying the fruits of their own labor.

Because as soon as you stop making excuses for why these ideas can’t possibly work for you, you can start actually doing them and seeing the benefits – today.

1: This is ALL WINNING and there are NO DOWNSIDES.

If you think there is even the slightest flaw with the ideas behind FIRE, you’re probably just not understanding it correctly. Because the whole reason for doing any of this is to lead the happiest, most satisfying life you can possibly lead.

Sure, there are a few tricks behind the curtain – I’m going to make you occasionally tackle some moderately difficult stuff instead of the lazy, easy things you are accustomed to doing. But this too is a win, because a lazy life is a sad, depressed, unsatisfying life. We are going to lift you up OUT of that bullshit. So from now, you can assume that any objections can be solved. Zero complaints allowed.

2: It Doesn’t Matter How Much Money you Make

Sure, many of the people most passionate about FIRE tend to be tech workers and doctors who happen to make a lot of money. When people with lower salaries notice this fact, they tune out and assume the ideas won’t work for them. When in fact, they work even better, the further down the income scale you go.

When I tell a Google employee earning $200,000 per year that she should not burn through too many $10.00-plus-tip glassses of wine at happy hour, she can rightfully respond that each one represents only about ten minutes of her after-tax pay. But what about the guy getting by on $20k? A ten-dollar expenditure is ten times more of a blow to his finances, and an even bigger portion of his monthly surplus income, if he has any surplus at all.

I’m not telling low-income people that they can retire in five years. I am telling them that they can make their lives better, RIGHT NOW, by spending less money on certain things that don’t improve any of our lives. Ten dollar drinks are one easy example, but there are dozens of other ones that I’m suggesting.

And dozens of ten-dollar bills start to add up to real money pretty quickly, which is something most people don’t realize. The vast majority of wealthy people are the ones who have figured out that a millionaire is made ten bucks at a time.

At the opposite end of the scale, earning more income will rarely solve your financial problems: most high-income people are still within just a few paychecks of insolvency, because it is possible to blow almost any paycheck, simply by adding or upgrading more cars, houses, and vacations.

A fundamental truth in society is that most people are pretty bad at math. At the core, these FIRE ideas are simply about taking some solid math, combining it with principles of human happiness, and then distilling it down into a list of simple tactics that will get you way ahead in all areas of life. The benefits go way beyond money.

3: FIRE Is Not Really About Early Retirement

Everybody uses the FIRE acronym because it is catchy and “Early Retirement” sounds desirable. But for most people who get there, Financial Independence does not mean the end of your working career.

Instead it means, “Complete freedom to be the best, most powerful, energetic, happiest and most generous version of You that you can possibly be.”

Does this mean you will quit commuting through traffic into a lame corporate office to sit in meetings about products you don’t really care about? Yes.

But does it mean you won’t work hard at things that are important to you, for the rest of your life? NO!

The people who lob this “retirement is bad” complaint against us are often the lucky ones – a professor who loves researching and teaching, or an established doctor who loves saving lives and happens to enjoy the work environment she has created for herself. But in real life, over half of people are in jobs they genuinely do not enjoy, and which they would immediately quit if they didn’t need the money.

Early retirement means quitting any job that you wouldn’t do for free – but then continuing right ahead with work in something that works for you, even when you don’t need the money.

If you’re lucky enough to find a job this good early on in your career, then congratulations, you can have the benefits of early retirement even before you have the huge nest egg. But don’t fool yourself – having the financial independence side of things is very powerful as well.

And because of this tendency of early retirees to go on through life and keep earning more money – at least occasionally – the issue of running out of money is even more remote. Most of us end up with a higher net worth every single year, even decades after turning in the keys to the cubicle.

4: You Can Be Happy on ANY Level of Spending

As a society, we’ve been trained to assume that having a bigger budget is always better, and cutting back always means some sort of compromise. The Suze Orman interview above is just dripping with that assumption. The amazing news in this department, which will save you millions of dollars, is that this is complete bullshit!

Happiness is your goal in life, and it comes from meeting certain core Human needs. The thing is, that there are many ways to meet each of these needs – some of them free and some of them shockingly expensive.

For example, improving your physical health is one proven way to be happier. But you can accomplish this with a $2500 per month personal trainer or a $100 set of barbells from Craigslist. Same happiness, vastly different cost.

And as it turns out, there is a similar hack for every single one of life’s major expenses. You can meet all your needs at little or zero cost – it just takes a bit of skill. At this level, you would be able to save almost all of your income.

Or, you can substitute a bit more money and a bit less skill to meet those needs in an (only slightly) more efficient lifestyle, like the one I try to lead. This might allow you to save half or two thirds of your income.

Or, you can spray money in every direction randomly, trying to meet an unfiltered list of wants and needs, and end up with a random but very expensive life, while remaining almost broke throughout the entire thing. This is what most people do, and it leads to saving almost none of your income.

All three choices are possible to do with great happiness. But in a bit of a paradox, the last and most expensive choice is the most difficult one in which to find happiness, because you end up with so many distractions and so little free time.

5: It Doesn’t Depend on A Booming Stock Market

I started this blog soon after the crash of 2009. Now we’re in the boom of 2018. Another market crash of epic proportions is coming sometime, probably pretty soon.

Our uninformed opponents think that FIRE-style early retirees are extra vulnerable to this. But in reality, it’s just the opposite: we are on a safe island, far above the choppy seas of the everyday economy. Because here’s how it really works:

6: Education, Health Care, or High Cost of Living areas are Comically Tiny Obstacles

FIRE is simply about making smart decisions with your spending so that you waste less money. This means that you have way more money available to work with.

The potentially costly monsters mentioned above are simply things that cost money. So if you get better at managing your money, do you think these problems will loom larger, or smaller, in your life?

For example, my son will be reaching University age in just five more years. I haven’t bothered to set aside any money for this part of his education, because we already had way more than enough before he was born!

On top of that, financial independence gives us many more options to handle any unexpected expense, whether it’s education, health, or anything else. For example, as a team my son and we parents could easily:

These are just a few ideas. The point is, every problem can be solved, and financial independence simply gives you more mental and money power to solve these problems.

7: The Only Thing To Fear, is Fear Itself

In the interview, Suze Orman goes on and on about what might go wrong, and how you need an incredible amount of money saved to protect you, just in case. But this thinking is completely backwards – money will not cure your fear, as megamillionaire Suze proves so clearly.

If you are afraid of what might happen in the future, you have a mental problem rather than a financial problem. So you should work on that first, by training your mind and body:

8: Place Your Bets Where The Odds Are In Your Favor

Because my brain has a math side I can’t turn off, I tend to see the world in terms of numbers rather than just emotions. And this is incredibly helpful, because by understanding probability, it helps me set up my life to ensure a much more joyful stream of those happy emotions.

For example: many people avoid cycling because they have heard from friends that it is very dangerous. But by doing so, they replace bike trips with sedentary car or bus trips, which clog their arteries and compound into fat gain and other medical issues which really are dangerous.

A lifetime of bicycling in average conditions might give you a 0.2% chance of untimely death due to accident – which can be slightly higher or lower than car driving depending on where you live. But a lifetime of drinking soda and skipping your cycling and barbell workouts gives you at least 50% higher chance of dying ten years earlier due to medical complications, while cycling reduces those health risks (and costs) considerably. So which activity is really the dangerous one?

With this in mind, which of these activities is more risky?

We’ll skip the spreadsheets for now and just boil this into a list of habits that really do give you the best chance at a good life: more happiness, better health and less negative stress.

So that’s the FIRE movement.

It’s a system of living your best life in all ways rather than just the financial, based on our best understanding of human nature, with a bit of math and science behind it. Like science itself, it’s not a dogma or a religion, but more of a self-aware system that invites questions and experiments. It’s always open for modification or improvement, but like science itself, there’s nothing for a rational person to hate. Who hates learning?

The reason it has spread to millions of people is that it works. People try it, they like the results, and so they share it with their friends, and the cycle repeats. There’s no stopping an idea or a movement like that.

*and guess who had the honor of writing the foreword for the new edition?

Note that I use Amazon affiliate links to point to any Amazon products mentioned, which allows this blog to earn money – so many thanks if you use them.

Another classic MMM article that will go down in history. This stuff isn’t rocket science as long as you reason from first principles rather than comparing yourself to drones blowing money like its going out of style!

A key attribute to those on the FIRE track is that we think differently. We make decisions to maximize happiness instead of making things the easiest or accumulating the most stuff. For those that don’t know anybody pursuing FI, they don’t get that FIRE is not about living a life of deprivation so we can quit our jobs, have no financial backup plan and sit around doing nothing. It’s about making a series of decisions so we can spend our lives following our passions. I agree that this post nailed it. Hopefully, Suze will read it so she understands.

So true! It’s all about the decisions you make. The goal is always happiness. True happiness can’t be achieved by laying around and accomplishing nothing. Instead, do things that you take pride in and enjoy. That’s far more fulfilling. That’s why the passionate doctor or teacher could probably work forever. One good point that Suze did make was that some people don’t pay attention to a long-term “enough.” If you live on $20k now with health insurance covered, save 25x, retire, and “all of a sudden” it’s $30k/year expenses… or if you want to do $10k/year slow travel but didn’t include that in your 25x and can’t quite make it up with Airbnb while you’re gone… these are things you should think through before leaving the work force if you’re one of the fortunate high earners. (You can always find another minimum wage job, but would you genuinely want one?) You really aren’t leaving a whole lot of buffer at the below-million portfolios, although it’s obviously entirely dependent on what you choose to spend. You don’t need millions of dollars just as a buffer, but it’s also worth evaluating what you’re comfortable with and really contemplating your long-term life goals. Don’t just drink the koolaid. I also agree with her point that if you’re unhappy with your job, find another that you feel passionate about. Life’s to short to rot away uninspired in a cubicle.

We occasionally watched Suze Orman’s show about ten tears ago, and it was often the same mantra: pay off your credit card debt (good) and make sure you have $2 – $3 Million saved up for retirement. “Wow,” I thought, “How the hell am I gonna do that on my current middle class salary and just the one income for our family of three?”. Turns out that MMM spells it out pretty clearly, as has my frugal better half for the past 25 years plus! We don’t need anywhere near that much to retire. WHY NOT BE CONTENT WITH A BIT LESS? ULTIMATELY, OUR TIME IS THE MOST VALUABLE THING WE HAVE. Let’s design our lifestyle for less consumption and happiness derived from things that truly matter. Of course Suze is going to tell people to consume more – would be tough to sell 30 seconds of ad time on a show that preaches not buying shit!

You’re forgetting the market changes! :) If your portfolio is designed to meet your needs during horrible economic downturns, that means you have far more than you need during average markets, let alone rising markets. There is plenty of extra money when you make your plans around worst case scenario; what if another 2008 crash happens two weeks after you quit your job? In the case of FIRE people, nothing; we designed our lives and our portfolios to take a blow like that without ruining our freedom.

So, if your magic number is 30k, and you design your portfolio to keep you afloat in bad times, it’s not unreasonable to assume you’ll get closer to 40k in an average market, and the sky is the limit in good times. If this isn’t convincing take a peek at MMM’s portfolio; without any additional investments, it’s grown and grown and grown over the last 13 years which includes the big crash in 2008. He doesn’t invest his blog earnings iirc, because at this point his money makes more money than he possibly could.

I think for most folks FIRE is a wonderful thing. I would caution that some fear is not a bad thing however. I was happily, frugally saving for an early retirement my hubby all ready retired when he got diagnosed with a rare cancer. One med alone is 15k a month.

Looking through healthcare.gov site this med is barely covered. His bills for the last 4 month are in excess of 200k. That’s what insurance paid. I hope this doesn’t happen to anyone but the prescription drug situation can be financially devastating.

I am so sorry to hear about your husband’s illness. I hope he recovers soon, that you both have healthy long lives, and thank you so much for mentioning the prescription drug factor. Anything can happen, and MMM’s idea of stashing cash in index funds is a great way to have it when you need it, even if its not for “fun” things.

I hope things are going well for both of yoU. Im probably on the same as your husband, with the same meds.. Luckily I live in Canada where this medication is covered for those in the bottom 90% of wage earners…

.

Make sure one accounts for this, ie get insurance that covers cancer medication.

Jason, While I agree a strong rebuttal like MMM is needed for Suze who lives in her multi millionaire bubble and hobnobs with the rich and famous, there is one point that many FIRE bloggers ignore. The idea that you can get some part time work when shit hits the fan in your portfolio is often ill advised. Bad stuff tends to happen together (“black swan”) so getting some side income when capital markets are bleeding is going to be much more difficult than what many recognize. I agree with the other points about flexibility and the solid math behind FIRE, especially with conservative withdrawal funding a reasonable (not bare bones) budget. With flexibility, many crises can be overcome but finding a part time job in deep recession can’t be part of the plan.

Sure it can Roman, as can earning money from your own business and freelance work. Which is one of the reasons I encourage everyone, whether employed or not, to keep their minds open for ways to make money without the need for an employer. Remember that even in the worst recessions, the US employment rate doesn’t drop below 90%. Thus, on average you have to be in the lowest ten percent of employability in order to not be able to keep or get a job. Mustachians are in the TOP ten percent, in general.

I think that’s the key point she misses. It’s not that you need $10 million vs $1 million. There is an incredibly small chance that even a larger sum than $10 million wouldn’t be enough to handle a calamity. Keeping skills honed and having side projects ensures additional cash flows can be made available if needed. What I hated the most about her podcast is that she is absolutely correct that life can throw things at you that are completely unhedgeable. That doesn’t mean that you ought to work in a career you don’t enjoy effectively hedging away any chance ary long term happiness. At the end of the day the biggest bone she’s picking with FIRE is that it usurps her role as America’s de facto retirement celebrity. She’s not coping well that her “retirement” wasn’t fulfilling and her legacy is fleeting.

Right.

Focus should be on starting a business or getting a job that gets your blood pumping like intense movie. It’s no way to live, every day going to a job you hate. If you are a mature and intelligent person, re-search your plan b to get out in the next 6-8 months. You will probably need to downgrade your lifestyle for a few years. But you keep dignity NOW instead of living a life you hate for the five to ten years, it takes you to become FI/FIRE. In it self aiming for FI and FIre is a scarcity mindset. “I need a certain amount of money to be free” – Wrong! Quit your job and see where you end up! I follow a YouTuber that lives in her car! Because she choose to do so, her name is Katie Carney.

@The Frugal Joker, It could be that mind set but it doesn’t need to be. Reaching FI is really just one of the first steps towards figuring out what kind of a life you actually want to live and having the support and ability to do it. I’m on my way to FI but I have no idea what kind of an occupation I want and it’s been 13 years since I finished college. I certainly could quit to see what happens but I see it as a huge risk for my family who relies on me for stability.

Of course a huge risk when you have a family and they depend on you. My comment was more for a person that is single. And only quit your 9-5 if you have at least 24 months worth to cover all expenses. As single you can cut rent in half by downgrade to a smaller apartment. But not easy if you are married with children.

Love this answer…so positive!I recently found out about the FIRE movement and have been reading blogs and listening to different podcast since January. I started tracking my spending, and without much effort dropped my food, eating out, and shopping $700 per month. Wow, that’s $8,400 per year! Thank you!

I applaud you for addressing the many naysayers. As you say, most of them don’t understand what “the FIRE movement” and its proponents are all about and they don’t want to. It’s easier to take someone else down, or make a failed attempt at it, than to face your own shortcomings and inconsistencies. Can we say “cockblocking” in our blogs? Yeah? Cool. Cheers!

-PoF p.s. it was great to see you last week. I hope you return to FinCon in D.C. next year.

If everyone needs to have 5 or 10 million to retire “safely” then most people who make average incomes will never be able to retire. That’s enough financial stress to give anybody erectile dysfunction as MMM much more elegantly states. Why would these average earners need $200,000 per year in retirement, when they’re making $56,000 per year now?

I was thinking the same thing, when she stated that the average US family needs $80,000 before taxes per year I was thinking “This woman is bat-shit crazy!” I put my wife through college and paid the mortgage and put away some money on $60,000 (Canadian dollars) last year, and we lived quite comfortably. Her math just doesn’t make any sense, we won’t need more in retirement than we spend already. Millions of people in the US and throughout the world live quite happily on a hell of a lot less than $80,000 USD per year, how long has it been since she set foot outside her multi-millionaire bubble?

You’re in Canada, so keep in mind Americans have to spend $5-10k USD per year to add their spouse/kids onto their work medical insurance plan. Please feel sorry for us.

I agree.. we absolutely dont have a problem with 60k Canadian ( but we have a house thats paid for)I laughed way too hard at your comment hahaha. It’s funny because it’s true. To be honest, I was probably one of those guys at one point. If you told me financial independence by 40 was possible back when I was 21, I would have reacted the same way and felt very insecure about it. In the end that mentality hurts the Self more than someone else, that’s my concern.

Use whatever words you want. But to me that stuck out as poor writing. It was distractingly and indulgently crude without helping to clarify anything. Even worse, it invokes imagery that, I suspect, contradicts how MMM would prefer to characterize the FIRE movement. “a bigger range of misconceptions” is not the typical perpetrator brought to mind by the verb ‘cockblock.’ That is a bit of an awkward construction. Worse, that word, unfortunately, brings up the image of a kind of swaggering, entitled attitude about male sexual conquest. Is that the image you or MMM want to bring to mind: the FIRE movement is by analogy a horny guy who is proactively hostile to anyone who might prevent him from sticking his dick where he wants to? I know that the word is often used in a light-hearted manner, but as a writer you can’t control the unpleasant baggage that it carries with it. It strikes me as a bad choice of words, used ineffectively, for the tiny payoff of projecting an offhand tone. MMM is a master of tone and character in his writing (which is a big part of his success) but this was not a great example of how or where to do it.

Schermo, I agree. I really bristled at the use of the word ‘cockblock’. But I didn’t decide to post a comment until this morning. In a section about overcoming living in fear, MMM suggests “Start each day with at least a one mile brisk outdoor walk – before you even attempt to work. This drastically improves your hormonal balance and reduces stress and fear.” Now, this is great advice. So, while I was tying on my walking shoes this morning, I was planning my walk. I’m a woman walking alone, so I have some things to consider. Do I use the city’s walking path which has a beautiful but heavily wooded and somewhat isolated section? Or do I walk on the street with heavier traffic and more visibility to more people? I should probably work out a system with my husband who’s at work to just text that I’m out walking and text when I’m back, just in case. No matter where I walk today, I should be sure that I vary my walk each day, so that it doesn’t become a predictable routine. Is there anyone in the neighborhood I could walk with? While I’m walking, I’ll need to be aware of my surroundings, aware of men alone or in groups, or worse, sitting in a parked car for no reason. Frankly, I might be safer on a bike, where I’m faster and harder to catch. But even then I should vary my daily route. Am I being unreasonably fearful? No. Just realistic. “A lifetime of bicycling in average conditions might give you a 0.2% chance of untimely death due to accident.” Here’s a different statistic: a woman’s lifetime risk of sexual assault is one in four. Women go about their life regardless, yes, but boy am I tired of this just being life as usual. And the more I thought about the whole thing this morning, the more I felt like I needed to call MMM out for this. I wish I could point to an article titled “What Otherwise Decent Guys Still Get Wrong About the #MeToo Movement.” Men’s entitlement to sexual conquest is so ingrained in the culture that even decent men don’t recognize how they contribute. To use your own words, MMM: “I care, because every bit of pollution and pointless inefficiency and unhappiness hurts all of us. And the solution is so obvious and easy. ” So, I’m going to point out what to me seems obvious and easy, to someone who I consider an otherwise great role model, because I just think you are better than this.

Agreed. As a lng time follower, I had to stop reading this blog for a while because of the language used, much as I love what Pete/MMM has to say. I give him huge kudos for inspiring many to take control of their lives, not just their financial well-being. This blog is generally a great read and the MMM persona is funny, witty, and wise. Mostly. Well, Pete, you sometimes have a tin ear when it comes to the use of terms that are violent and verge on the use of a kind of toxic masculinity. Yeah, I get that you really are a feminist (ie., your wonderful pride in your wife’s accomplishments, among other things.). This is just pointing out that this kind of language crops up when you get steamed about some injustice or stupidity—it’s a reflection of your boundless enthusiasm for the subject-matter, but it actually doesn’t make your point stronger. Not talking just about salty language, but about terms like the one you used in this post. Mostly in the past, I just read right past it all, but then it was too much and I tuned out for a long time. As the writer above noted—- you are better than this. You have also become a better writer than this over the years. Just saying. Otherwise, keep up the great work that you do—it makes a difference in this world.

This is over the top ridiculous. Shame on MMM he should have said a “brisk walk” not a “brisk outdoor walk”, since women, people who live next to cliff(s), people who cannot walk, people who cannot walk briskly, and people who live in extremely hot or cold climates might possibly be offended. The level of ego in our society must be at an absolutely unprecedented level right now in the history of humanity. Get over yourself, you are better than this.

One of your best summaries yet… this should get another few million on board and keep the wave going. So glad I stumbled onto your site a few years ago and shaved years of working from my life…. Couple more years should get me over the hump.

I was so curious about Mr. MMM”s response when I saw Suze’s interview on Afford Anything and a whole range of articles that came from that podcast. The points raised in this post are great indeed. Everyone ones to have 5-6M to retire early. But maybe Suze is one of those few people that can get her hands on that amount of money at her age? I think she will get a lot of backlash from her statements whether those are valid or not.

I agree with your points, M3, but there’s a small kernel of what Suze said in her interview with Paula that resonates. For instance, you shouldn’t assume an “old fashioned retirement” at 30 with $1M in the bank. In her mind, many in the FIRE ranks are on permanent vacation. Which we know isn’t true. Ms. Orman would have none of us retire EVER. But that’s because she’s found the magic beans – i.e., a job she’s passionate about. When IT kids and med school kids like us get into our cubicles and operating rooms, we start to dread the routine and stress. Suze gets to create and run her empire. That’s I think the main disconnect with her understanding of FIRE. We ALL want to have that passion, but we need financial independence to really rock that canvas.

Well, if she said we were right, most of her books will be useless. Bad for business! Still think she is having a major marketing stunt here, look at the amount of times ‘we” write about here. Negative publicity is still good publicity! Moving on, still have some wealth building to do ;-)

Nailed it! Sad that it’s that blustery “stunt” style that so often works with people. It’s like a punch to the face. Wait a minute…

Exactly! There are times when you can’t wait to get up in the morning and go to work. All it takes is a job loss or a project switch to change that. If that time comes, do you want to be able to walk away, or be desperate and stuck? I finally had some time to listen to the actual podcast and it’s like she’s halfway there and is getting hung up on semantics. She says “I work when I want to; when I don’t want to work I don’t work.” Hey, look at that! Then later “I love doing what I do. I don’t care if I never make another dollar from it again.” Then she goes on about “AI is gonna take all our jobs, no one will work! Who will pay into social security??” What? This is EXACTLY why people strive for financial independence! I’m about half an hour in and she goes between making a good point, something that FI folks already know and tell others, then diving into the grimmest, most bleak version of the future I’ve heard in a while. She even describes people putting guns to their head because they ran out of money. I think having a worldview like this, where every person needs to grind out tens of millions of dollars to avoid a hellish, painful existence, is much more harmful to someone’s mental health than having to cut back on spending later in life. There’s a lot of good stuff here, like messages about female empowerment, and valuing your talents, resisting lifestyle inflation, and avoiding high-cost mutual funds in favor of low-expense index funds. I think if she was more read up on the tenets of FI she wouldn’t see the need to express hatred toward it, and could probably get along pretty well here.

Just finished the podcast, Paula Pant covers all of this way better than I could once Suze Orman signs off.

I couldn’t get past the point where she finished bashing people for wanting to retire and travel for a few years, then the question came up “What if they want to be a full-time mom or dad” “OH, well family is the most important…” What the hell? I’m allowed to leave work if I want to raise kids, but if I decide that I want to pack it in, travel, then do something else I am not allowed? Such stupid logic. The topic of AI really annoyed me because my wife and I work in fields where AI is taking a huge role. We’ve both been told that our trades will be replaced in years, get educated in something new or get used to collecting welfare. AI just results in more work, which needs more humans to manage (humans still have to be involved in the process) which means our departments are pushing to hire more people to handle everything that the machines are pushing our way. As a kid I remember hearing that digital programs would push accountants (and other number-crunchers) out of work, one accountant with the right software and networked systems can do the work of ten people with pen and paper. Somehow accountants (and others in similar fields) are not on the streets.

After having listened to this interview, I don’t think that she makes many good points. She mentions that we will all need $250K/year in retirement, makes the emotional appeals (“when you get old, like me, you’ll understand”). You are going to get injured and need disability insurance… I think she really sums up her argument towards minute 24, when she mentioned that her cousin committed suicide (over money), and that “you should work as long as you possibly can, in a job that you love”. To that, I don’t actually think that most FIREs would object.

So true – fear sells unfortunately. Keep things simple, invest as much as you’re able, and live an overall happy life with the power of positive thinking :)

Hola amigo, Just checked your blog as I was missing good MMM stuff and boom☆ another fantastic article.

FIRE going strong here in Dubai and we can almost touch it with our fingers… a few months away. FiRe movement really well explained.

A big fan here and thanks for the time last year in Equador.

How do you help people get better at self-control? Because… bad behavior. I mean, let’s say you buy the $100 set of barbells. But you never use them. And with the personal trainer, you’ve paid so much that you’ll go. I think that’s the missing link in your article. How do entitled, financially flabby Americans start and continue to make better money and life decisions?

Checkout TinyHabits.com — free program for forming new habits by Stanford behavior scientist BJ Fogg. Habit formation is a skill–anyone can learn and use.

I too recomend BJ Fogg. https://www.youtube.com/watch?v=AdKUJxjn-R8&t=137s“Most of us end up with a higher net worth every single year, even decades after turning in the keys to the cubicle.”

That is the key. Even though that is easy enough it is not necessary. Once everything is paid off you can live really cheap and as long as you are careful you can spend down savings and be sure to have some left over for the kid(s). Even better than that, your giving your kids the financial education by example that they need so they won’t care about any inheritance.

Suzie’s example of “only” having 80K per year is ridiculous. If you can’t live on 20K per person per year than you need to move and rethink your spending. That comment shows her lack of understanding of the spending portion of FIRE.

Keep up the good work.

The median household income in this country is 56k; there is no such thing as “only” 80k per year. She is ridiculous.

Hey MMM,

Thanks for this refresher! The thing that I and my wife have always appreciated about your blogosophical opinions is the emphasis on quality of time. There are a lot of ways to that, and we try to emphasize the keep-the-spending-low side, and live well with our time right now. Having a bunch of kids helps emphasize that. Besides, being an Orthodox Christian makes it unpalatable to think about sitting on large sums of capital, but provides many great examples of living joyfully on next to nothing. So I’m going to close my cushypants-Apple laptop and go feed the chickens and rabbits. Maybe I’ll get to do some lab work in a cleanroom later, for a friend. Have a great day!

Mark

Couldn’t agree more! They can’t stop the movement! “All truth passes through three stages. First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident.” -Arthur Schopenhauer

“We are all in great danger of living lives conceived by others. There is a small but growing proportion of the population that recognizes these pressures and their danger to the world. They are responsible for most of our moral and cultural progress, because they don’t gravitate towards norms. They find better ways to live and work, and often the norms begin to gravitate towards them.” — David Cain

So I guess I’m in somewhat of an struggle. As it is, my wife and I are able to save around 50% of our take home pay. She feels it’s hell of a lot already but a big part of me still feels we can save even more because I still feel a lot of the stuff we spend on is really unnecessary. But I guess when does it become a balancing act? Perhaps it’s all personal feelings so there is no answer… my wife still feels like we are ‘trying hard’ to save. Whereas I don’t feel like it’s ‘trying hard’ at all – it’s not at all a hardship to reach this level. But admittedly, surrounded by people without the same mindset, it would seem extreme…

50% is damn good. Better that you both align on your shared financial goals and enjoy your life together, rather than taking that dreaded death-march to early retirement. Been there, done THAT (except the early retirement part at the end – still working on that one.)

Hey Jason, I don’t have a whole lot of advice, but I wanted to let you know that you aren’t alone. My dw and I are saving just about 60% of our income but dammit if we couldn’t be saving more. Further, I can see her willpower starting to slide now that the rainy season is starting. It seems like the only answer is for us to be gentle in our interactions with our dws as saving 50 or 60% is already a GREAT start. I hope that with patience I will have more success continuing to whittle down our frivolous expenditures. Ultimately, the worst case scenario is resentment among partners. Good luck.

“Unnecessary” is subjective. She’s always going to spend on stuff you don’t value, just as you spend on stuff she doesn’t value. You are adults with different preferences. That’s fine, as long as 1) you both are broadly aligned on the big stuff, and 2) you are able to respect each other’s choices.

My husband and I do luckily agree on the big stuff. But a game changer for us about 6-7 years ago was to build in about $80 per month for each of us as “blow” money…no accountability at all required. For us, this was brilliant.

Well… I am in the same boat with my dear husband… we save about 50% and to me it is not a sacrifice… sometimes I get itchy and want to move it along faster, but I am a naturally frugal person. We try to discuss why an expense is important to us and sometimes we don’t agree, but we are on track in a reasonable amount of time to be FI. It is a balancing act and he has come a long way…sometimes I need to make sure my frugal ways don’t get in the way of living either.

I don’t know your family, so take this with the proverbial grain of salt, but what kind of expenses are you trying to cut? A lot of the discretionary spending in my family is on dining out, and that’s something I’d like to break down a little bit. Luckily, I’m the more frugal one, so I’m ok with some of the sacrifices we’re making, but a huge place for us to save is on food and eating at home. I am not very fond of cooking, at all, whereas my partner is. Because of my partner’s schedule, though, I’m the one that ends up doing the vast majority of the food shopping and cooking duties, in spite of the fact that I don’t care for it much at all. I find ways to distract myself through it, but it does sometimes feel like a really raw deal. He gets great fresh dinners and good leftovers for lunch, and yes, I get a good meal out of it too, but I’d probably just eat cereal instead or save in other places and get more takeout if I were left to my own devices. This is not an uncommon situation among many of my friends, and yes, it tends to end up with the women getting home from work and immediately having to launch into a second shift of house work. An awful lot of the discretionary spending in many households is related to chores or tasks that often end up falling on the female partner if we’re not careful – dining out, cleaning services, laundry services, etc. I would definitely evaluate and make sure that you’re not increasing her workload disproportionately with the changes you want to make. It can be a hard balance (my partner works later than I do so it’d be a little silly to just sit around waiting for him to get home to cook), but it’s really worth checking on. I don’t have any great advice if it’s stuff that’s the problem, but I would really advise looking at the breakdown of household labor if she’s feeling put-upon with the savings plan.

Jennifer : Not all or nothing re cooking. Reiterating the usual: Maybe use prepared ingredients, some readymade supermarket meals, slow cookers, etc., one weekly meal of cheese/breads and salad, let him cook in quantity when possible for later use. A neighbour, who eats similarly, cooks for me: she makes money and I pay far far less than a restaurant meal, as I pick it up and use my containers. So no cooking/ shopping, etc. apart from simply cleaning the containers. Could ask in your neighborhood.

Namasteyall, you’re absolutely correct! There are some *slightly* more expensive, slightly processed ingredients that make life easier. It’s honestly a huge improvement when we are organized and plan out the week’s meals in advance, and we do keep a frozen pizza or two for those days when the alternative based on our time and energy would be take out. For me, cooking’s usually ok if it’s just following some instructions with ingredients I know we have for a meal we’re both looking forward to. What I was getting at is that the default for doing so many of these chores, if they are not outsourced, tends to fall on one partner more than the other. If the OP feels like his wife is resistant to more cuts, I think he needs to seriously evaluate how the extra work is getting divided. If it’s stuff, the thought did occur to me that they should try to figure out what is motivating the purchases; buying time, ease/relaxation, status? Most purchases beyond the basics can be broken down to these (in my experience), and knowing which goals motivate her might reveal some ways to curb it.

Jennifer…have you thought about crockpot cooking? If he enjoys cooking so much and starts later in the day than you do…it’s totally possible for him to prepare dinner in the crockpot before he heads out for work. These are often filling, nutritious meals that taste amazing and generally leave enough leftovers for dinner the next day or lunches for work.

I so completely agree with you and feel your pain on your points in your response.

This sounds like the scene in the Woody Allen movie where he and the character played by Diane Keaton are describing their sex lives to respective therapists. How often do you have sex? “Hardly ever! Only three times a week!” vs. “Constantly! At least three times a week!!” While this does demonstrate tension.. it also demonstrates that you might be in the “right” savings spot, and that sitting down and comparing notes about it might help.

Love this quote the most: “And because of this tendency of early retirees to go on through life and keep earning more money – at least occasionally – the issue of running out of money is even more remote. Most of us end up with a higher net worth every single year, even decades after turning in the keys to the cubicle.” The idea that you need a gazillion dollars to be financially independent or retired early presupposes that you’re bad with money in the first place, which if you were, you wouldn’t be in a position to even be having this debate. More money means more choices, of course – and more opportunities – but it’s not simply a “how big is your number?” question. Because if you make financial independence a priority, by the time you are in a position to walk away from traditional employment – if that’s what you desire to do – then you’re likely already going to have your own specific skill set that gives you a lot more financial security than the gainfully employed who still live paycheck to paycheck. I haven’t been an employee myself in about 9-1/2 years – and I now have skills and insights (financial and non-financial alike) that I NEVER would’ve developed had I remained on the conventional path.

Good point. It seems that there are many people out there who simply cannot think outside the box with regard to personal financial independence and “retirement”. In this country, we seem to like everything pre-packaged and spoon fed to us: what pill should I take to fix my health problem? What car should I buy to project the right image? How much can I afford to borrow to buy the house that we “need”. How can I save the $5 million that Suze tells me I need for retirement, so I can continue a lifestyle of conspicuous consumption until I croak? The beauty of this blog and the reason MMM has so many followers, is that we have realized that these are entirely the WRONG QUESTIONS to be asking ourselves in the first place! The drone people are starting to wake up! ;)

Your approach to personal finance (get absent-minded spending and car usage under control) and time-restricted eating (get absent-minded food consumption under control) are working really well together for not only my waistline and my bank account, but surprisingly, my household chore backlog.

Clarification: time-restricted eating was an idea I got elsewhere, but the slight self-restraint needed to carry it out also assists with financial self-restraint. Keeping me out of the bakery on the way to work is a savings of 4-5 EUR and 300-400 calories that I’d just become used to.

Great article! Some people don’t understand that it is about doing what you want with your life whether it is work you want to do, hobbies, etc. I do follow the news just because it is important to me to be involved and stay on top of things. I used to like Suze but she has just gotten ridiculous with her advice. Many people won’t live to 70 or be capable of working until then. Ugh!

I can appreciate the opportunity to leave our FIRE echo chamber and hear some opposing views. But that interview was a train wreck of self contradictory and poorly thought out arguments against FIRE. There was a superficiality to her critique that suggested she hadn’t really put much thought to the choices on offer. Arguments are good. It is how we hone our ideas. Plus It is kinda fun to think about how I would have “face punched” back against the “Suze slap down.”

The media seem to always forget that a lot of people are not actually retiring early, they’re just doing other kinds of work without worrying about money. They also did a study that showed that kids succeeded when parents were involved in their lives. Going to an expensive school is not necessary.

Agreed re gainfully busy parents. FWIW, a study quoted long ago in NYT said the only similarity between widely varying cohorts of successful teens was : they ate at home with a concerned adult/s, mostly every day. Most traditional immigrants usually insist on this.This seems to have had a major effect on the teens well-being and success as adults: healthy, responsible, with good goals and manners, etc.

Long time reader and “fan” of your writing and larger example, but I don’t understand something fundamental to your thinking. Who cares? That Suze Orman and others hate the FIRE movement? That lots of people are critical of aspects of the Financial Independence Movement? That misperceptions abound? How do inaccuracies or flat out negativity effect you or other adherents of simple living? More generally, apart from the serious, negative ecological consequences of mindless materialism; who cares if someone chooses a long commute to a corporate cubicle? The stridency—everyone can and should follow our example to live better lives—almost harkens of evangelical Christianity. Or intense political partisanship—if only everyone was a Democrat or Republican like me. Every time I walk into the weight room, I see people with scary bad form, but that doesn’t mean I give them unsolicited advice on what to do differently to avoid injury. I totally get sitting around talking in-depth with close friends who are interested in all things financial independence, it’s the caring about what other people think and the proselytizing to the masses I don’t get.

Do you really have to ask why I care about our society’s perception and adoption of these ideas I’m sharing? I want them to SPREAD, and spread quickly. If I didn’t care, I wouldn’t be writing this blog. I care, because every bit of pollution and pointless inefficiency and unhappiness hurts all of us. And the solution is so obvious and easy. My own problems and those of my close friends are already solved. Once you have your own shit set up nicely, it’s a pretty natural instinct to turn outwards and try to help others. And it’s also hella rewarding.

Hi MMM,

I loved your speech at FinCon last week and it’s truly inspired me. I wholeheartedly agree with everything you said and I admire your courage to speak up and continue to spread your ideas even in the face of backlash.

No offense meant, but I do. Concern about pollution is admirable; but “efficiency” and “happiness” are relative terms. That’s why social scientists use the term “subjective well being”. If the ideas were truly “obvious and easy” financially independent minimalists wouldn’t be a distinct minority.

You can’t know what you don’t know. How do people who don’t understand FIRE know whether it may or may not be applicable or beneficial to them? They hear about it through folks like MMM. I’ve yet to see any post anywhere about FIRE that leans towards ‘thou must submit’. Obviously, FIRE does not rely on ‘new members’. Its a way of life that can be accepted or dismissed. Think about what you, yourself wrote. Why should anybody be concerned about Pollution? Then re-visit why anyone might be concerned about the FI piece of FIRE.

Maybe you SHOULD help your fellow lifters out with unsolicited advice, before they blow out a knee or herniate a disc. They might even be grateful for your thoughtful intervention (like I am economically, with this particular blog here.)

This site might benefit by having like buttons. Cubert gets a smile here. “excuse me, please do not step off the curb, that is a dump truck in the bike lane moving at 40 in a 15 coming along.”

Ron S you kidding me? I’ve been waiting for a blog like this for 5 or 6 years now! Glad MMM has a pulse. Keep more like these coming!

Great article MMM! It’s never been about the money. It’s about maximizing happiness, and being cognizant of the path to achieve that happiness.

GOod breakdown of the topics from this (very polarizing) talk. One thing that helps me understand where Orman is coming is that a large number of her typical audience are people in debt or those just beginning their financial journey. For those that are in a position where they are out of debt, are saving and are (most importantly) forecasting investments they probably aren’t listening to Orman. It’s kind of like the business saying: “No one ever got fired for choosing IBM.”. No one ever got fired for saying “work longer and you’ll be more secure in retirement.” It’s true, but it’s not the full story, and may be way more than you need.

I find it interesting (and sad) that so many people disparage the idea of frugality, saving, and the FIRE movement. If you don’t like it or don’t want to do it, fine, but why discourage those who want to give it a shot? I’m not at the die-hard Mustachian phase, but I’m on my way – currently debt-free (except for a mortgage) and saving/investing 35% of my income with plans to increase this amount. Given the impact Suze Orman has, it amazes me that she’s so negative about alternative approaches.

Hi guys, I´m a new MMM reader.

Do you know of an easy way to have some kind of text to speech to be able to listen at MMM articles while commuting?

Some blogs have an Alexa skill — like Mr. 1500 and Nomadic Matt, for example. A number of podcasts are on there, too. https://createmyvoice.com/clients.html Perhaps an MMM skill will be created one day.

If you have an android device:

Go to Settings

Select Accessibility then Text-to-speech

Choose your speech engine You can either learn how to use Google Talk-Back or just use Select Text.

MMM, This right here is spot on:

“If you are afraid of what might happen in the future, you have a mental problem rather than a financial problem. So you should work on that first, by training your mind and body:” Suzie’s comments in that episode are pretty comical really… Great seeing you again last weekend. Take care man!

I agree with your article for the most part. However, I am a big believer in not tuning out local news completely, at least when it comes to politics/current events that directly affect your loved ones and your greater community. I think a lot of problems in American society today are a result of people ignoring the local world around them and not educating themselves about local matters and then not voting when it really matters. Just around the corner from my town is a town facing a future of a liquified gas line going through, close to schools and higher density residential areas, all because not enough people got involved enough to prevent it from happening. I know not every person can be involved in every local issue, but ignoring all things local is not the answer. Those who face persecution, especially those from minority groups, would also agree with paying attention to local and state current events.

Here, here! I’ve been a reader since (nearly) the beginning, but have never been able to get on the ‘tune out daily news and think of the long view’ train. What’s happening in our country today, as you say, is because not enough people are paying close enough attention, some with their heads willingly in the sand because (for example) children forced into tent cities in Tornillo don’t directly affect them or their pocketbooks.

Ahh, but does YOU reading the news daily help change the fact that other people have their head in the sand? No. Just place your own vote in the ballot box, then focus on improving yourself and gaining influence, then use this influence to help other people place their votes differently next time.

Hard disagree, Pete. Reading the (local) news means you can talk to your local politicians in an informed manner, to help them make things better for everyone. Let’s look at housing, for example. One of the Mustachian techniques is to retire in a LCOL area. However, HCOL areas have many more job opportunities for your kids, better public transit and bike infrastructure (sometimes), and numerous other perks. Or maybe you just have family there already, and don’t want to leave. Your political engagement, whether it’s showing up to local community meetings, dealing with your local councilmember, or even running for office or starting an advocacy group can mean real, actual change. Helping to get that HCOL city to adopt that new piece of legislation to make it easier to build new housing, for example, or more varied types of housing (like MIL units/backyard cottages). Ignoring the news cycle means that your politicians will hear mostly from cranky retirees who want the city to return to the 1960s. That matters. Politicians will tell you that hearing from these cranky folks affects their decisions, wears them down, and bullying sometimes works. If you’re ignoring the local news, you’re letting that happen. I will say that certain types of news is definitely worse for you, and is best ignored, though. TV news, for example.

but local news would fall more under the realm of things that affect you and that you can control, so they’re certainly not a waste of time, or at least much less of a waste of time. i think the point MMM has tried to drum home in the past is that it’s a monstrously huge and complicated world out there, and much of what goes on in it is way, way outside of your sphere of influence. it’s also the nature of media to present information that shocks you, makes you angry or sad, and thus provides you an extremely skewed picture of reality. you can spend all day everyday on the wild goose chase, supposedly educating yourself on the latest tragedies and scandals, but to what avail? what are you giving up within your circle of control to be occupied by this skewed picture of reality? what extra stress and anxiety are you causing yourself? so it’s not all useless by any means, but there is a very legitimate danger (by the nature of how these platforms are explicitly designed) in being consumed by it at the expense of more productive personal endeavors. the most powerful way you affect the world is in your daily life – your work, your family, your relationships – not through your reading of the latest headlines in the Times or the Washington Post or while perusing your Facebook or Twitter feed. for me personally, particularly social media became a major time waster and stress-inducer. i’m way better for having cut all that out, even if it comes at the expense of having my head in the sand a little bit. it’s not a matter of striving for ignorance, but i’ve removed a lot of the stimulus that used to have me chasing down links for hours at my desk or at home during supposed down time. you have to pick your spots.

My issue is that many issues that are national and international, affect me locally. Some of which I can effect (even in small doses) and some of which I cannot. But if I’m not informed I don’t know which. And as someone who volunteers with a national organization that helps and resettles refugees I personally cannot align with the idea that all I care about is what happens locally or that all I can affect is what is immediately local. I do agree that the news can be overpowering and that we need to pick and choose. I choose one paper, one half an hour of news a day and the occasional headline. But as someone who has sponsored a family from Africa, I can promise you my sphere can go farther than the ten miles around my house if I choose.

Pete– As a happy medium, do you have a news source locally that you read for an hour per week, or 15 minutes per day a la your reading of The Economist? As a news junkie, I’d like to find a happy medium. I do want to stay informed, but I also recognize that reading two dozen articles per day (including those on this site!) is mostly just a form or procrastination on shit I actually have to get done.

It’s amazing the misconceptions that people have about FIRE and dare I say it, how little people think of the people that have accomplished it. I mean, most are extremely accomplished, smart, resilient and flexible people who know how to act and evaluate their circumstances and surroundings. Do people not think they understand the risks? I’d argue they know the risks and how to combat them more so than those making the accusations. Well done pointing out all these misconceptions about it.

Yes, The FIRE community is comprised of independent thinkers that thrive on introspection. I suspect a lot more people working in cubicles at 64 with limited savings think about suicide that than early retirees that have been FIRE for 30 years. I agree with a prior comment that when S was speaking, she sounded like she was describing FIRE until she drove into the proverbial ditch and started with the fear porn. I think many of the commenters are addressing the fact that you can so much… but I would rather face a problem as FIRE than up to my neck in debt and scrambling month-to-month. I enjoy my profession; a big part of the satisfaction comes from the fact that I CHOOSE to only work for institutional clients, I do not take bad assignments, I don’t work for A-holes , I don’t cut my fees (b/c I don’t have to), etc. If I HAD TO do the opposite, I would be miserable. I am not nosy, but I wonder if Suzie has flood insurance on her PRIVATE ISLAND?

money will not cure your fear, as megamillionaire Suze proves so clearly.. Drop-mic, walk off. She did come off as full of fear, and as I commented on other blogs according to her nobody is financially prepared for a major disaster. But we who save millions and spend minimally are way more prepared than most. If she hates us FIRE folks I’m wondering how much more hate she has for the average 50 yr old in America who only has about a $100k net worth.

To MMM’s point about not needing a lot of money, my wife and I are currently pursuing FIRE on a single $55,000 per year income, with two children. We are both 30, and currently estimate we will be financially independent by 45. It requires a lot of lifestyle changes but is so worth it to be able to retire at 45. Early retirement is in reach even for lower-middle class single income families; it all comes down to the choices you make and the lifestyle you are willing (or unwilling) to live. I would love to talk further with more people trying to make this work on a modest income. Don’t believe the lie that your early retirement is limited by your current paycheck!

Thank you for your comment – here is my story: After spending several years in school, I finished grad school happily married with 2 kids, not much money, and the possibility of starting to earn a 6-figure income. However, I realized I really loved teaching, and have been teaching at small schools ever since. (For those not familiar, your typical university professor does fairly well, but those of us who are at community/junior colleges do not make so much.) I’ve been making about 50k/yr, and we have grown our family to 4 children. Due to a kid with a disability, my wife does not work.

With all of this, we still manage to save around 40% (we’ve saved/invested at least 20k most years). We cook most of our food at home, because we like what we make better than most other options anyway. We have two cars, but I walk to work every day (under a mile – I know, I am lucky) and most of our grocery runs our by bike (2.5 mi). I’ve recently expanded my carpentry, electrical, and plumbing skills so that I could improve our house (bought as a foreclosure) – 10 years ago I had never done much more than chop the end off of a 2×4. With our style of living, even on a modest income and 4 kids, we hope to achieve FIRE also by about 45 (currently mid-thirties). I still love teaching, so I may continue to do so. I may also talk my school into an extended leave of absence, as I would love the chance to join some humanitarian aid groups around the globe. I don’t want to travel as a tourist, but I would love to live in and come to know some additional cultures around our amazing world. In short, thank you for chiming in. Many of the ideas pushed by MMM and behind FIRE are incredibly empowering, and do NOT require a minimum income level or easy life circumstances.

I was hoping to see a response to Suxe’s inflammatory, kill FIRE with fire post. Thanks! There’s folks in the forums here that state it better, but I believe most FIRE advocates recognize and account for their own fears of financial implosion. Ms. Orman is a smart, and successful, and passionate person. I think her intentions are good and I also think she may not have as much insight into FIRE as she could have if she talked to a few people that are on the journey. Her warning is sound in many ways for those uninitiated that might view FIRE superficially at this time. The everyone-else-is-going-it types. As MMM points out, this goes beyond dollars. There’s an extremely huge mental shift that needs to take place to move from consumma sukka to enlightened and disciplined Mustachian. I hope MMM gets the chance to have a dialogue with Ms. Orman at some point!

Joshua from the Radical Personal Finance podcast pointed out that it would take roughly 5 years, depending on your rate of return, to save the traditionally recommended 6 month emergency fund. There is the assumption that 90% of your income is what your expenses are, but it the point stands. The 10% route takes too long. It would be very easy to lose motivation to save with such little progress. What might go wrong is a lot of the reason I am on board with the FIRE community. If my high paying job goes away, my investment income and stash will keep me in my house longer or give me time to move and sell it. Skills acquired through DIY could help me get an entry level skilled trades job. I think it would be irresponsible to put my kids’ wellbeing at risk by being completely reliant on a job in a single industry. I think NOT pursuing financial independence is risky.

I just want to give hope out there to those that feel you can’t retire early with kids. My husband makes about 85K, which he just jumped to this year after a large raise. I am a stay at home mom. We are 35 and have 3 kids. We will retire by 45. This means that my husband will quit his stressful job and work part time for himself, as will I. We will have enough in our retirement accounts to live off of the interest once we reach 60 until death. We are currently so close to paying off our house that it almost hurts and we will then work on middle money (the money we will live on from 45 to 60.) We have done all this by shrinking our lifestyle and being content with what we have. We have never made 6 figures. We are currently making the most that we ever have by far. We have done all this by not buying things that we do not need, not taking out loans (except for a house), driving 15 year old cars that still work just fine. Our kids are super happy, content, and grateful children. We are just short of minimalists, which means our house is uncluttered and peaceful to live in. We are HAPPY! At first I thought that you couldn’t do this unless you had no kids and a high paying job, but that just isn’t true. Just take it a day at a time, a purchase at a time, and your money will snowball! Thank you for this blog’s message and advice. It is very motivating to read.

You can’t help but wonder if Suzy is in bed with the insurance companies based on the amount of fear mongering she does in her interview with Paula. Would I rather work forever and stash away enough for any conceivable possibility? Or, retire now, live my best life, and take a small risk? For me – I choose the later.

I think a lot of the fear and skepticism come from an understandable place. Each of us, when we first read MMM or some other FIRE proponent, had the initial shock factor to some extent. We’re creatures of comparison; an unfortunate side effect of outliers like MMM gaining fame is that Regular Joe sees a role model that is so far from the norm that he doesn’t think himself capable of that level of dedication and swears off the FIRE Movement before his flabby frugality muscles even get a workout.

This may be this blog’s definitive article (TO THE SIDEBAR!) I love Headspace and ended up getting the paid version, but honestly I got the most use out of the free Basics pack. I think everyone should go through the first 10 days or so at least. Also I did buy YMOYL a few weeks ago and was pretty stoked to see who’d done the foreword (too late for your affiliate link I’m afraid, but I’ll click some ads in your honor).

I saw an article about this interview and I wanted to facepunch my phone. Gah! I was hoping the MMM signal would fly and draw the mustache himself into the fray to dispel such foolishness. And so it was! Another thing I would add to the list is the process itself. I started on the mustachian path about four years ago, first buying a house (where I live, my mortgage on a great house on a 15 year loan is about what I would pay to rent a terrible place), then started stashing. I’m a journalist (yes, a journalist who understands FIRE!) and fortunately work for a small independent newspaper that has paid me pretty well, especially recently. As a journalist I’ve always had to be frugal, and as someone who put themselves through college as a returning adult, doubly so. Learning to live with less helped me transition into mustachianism quite well. But I still sucked and continue to suck and will always be working toward getting better. Even with only two years or so of actual stashing, I’ve noticed a change in my workplace interactions. It helps that we as a country have transitioned into a employee’s market, but having even a small stash in the bank has helped me relax at work a lot. I know that if I lost my job tomorrow, I would be able to float myself for a couple of years, giving me plenty of time to find something else. That’s not the freedom of knowing you can just walk away for good, but it takes away the immediate panic. The other benefit while pursuing FIRE is that by learning to live on less, when bigger expenses pop up or you just really, REALLY do just have to have that new gizmo, there is a breathing room that allows you the occasional indulgence. (With appropriate self-mockery, of course.) I rarely make this choice but hey, we’re all human. To me those are all benefits you get while pursuing FIRE, as you pare your spending down. A lot of focus is on the end result, but frankly the benefits start much earlier than that. My dad, who lived fairly frugally himself and retired early-ish, told me when speaking of FIRE to make sure I enjoy life along the way too. Considering I just got back from a yoga trip to Mexico and connected with some truly great people, I could only ask what on Earth he was talking about! I have many friends, outside of work activities and projects, and a great life. It’s not spending, it’s people that make us happy!

Well I am one of those newbie Mustachians who discovered your blog thanks to the positive New York Times piece. All I can say is THANK YOU, THANK YOU, THANK YOU. In one month, I have managed to cut about 25% of bullshit spending, leading to about an extra $1k in savings that I am now smartly investing in index funds. I’m 33 and had my head in the muck for too long – spending all my money as soon as it was earned and not thinking at all about my future. Your optimism, positivity, and emphasis on family, friends, and experiences over wealth or conspicuous consumption make me want to live a more simple, happier life. I already feel 10x lighter. I’ve sold a bunch of clothes and old DJ equipment I hardly touch. I’ve been cooking every day and eating healthier/better than ever. I cut some subscription services that don’t serve me. I’m even cutting the cord on my beloved luxury gym — $215 a month is ludicrous and home workouts save time which equals more sleep/relaxation/play with my dog time… yes, I know dogs are optional but so are kids and I’d choose a dog over a baby any day ;) I’m now strongly considering moving out of NYC. I was born here see, so I think New Yorkers are terminally unique snowflakes (*eyeroll*). Not even millionaires can afford to live here “comfortably”. I am grotesquely overpaid with cushy benefits and I know my salary would be drastically reduced if I moved elsewhere (I’ve checked job listings for comparable posts in other cities). But I’m not exactly happy commuting to work for 90 mins a day on a sweaty, smelly, stuffed subway that rarely runs on time, or at all. And living in a tiny studio apartment is fine but I could also live in a tiny studio for less than half the price somewhere with clean air and less agita! I’m rambling but again, thank you and thank you to all the Mustachian commenters here and on the forums – I’m working my way through all the articles and am becoming wiser, more stoic even, by the day.

Excellent post. I think mental health should come first, though. Making that your priority makes everything else so much easier. (Even if it’s still difficult.)

Right, but physical activity has the single biggest effect on mental health and depression – stronger than any medication or therapy. So, start with that. Even if it involves doing a daily run to your therapist or doctor and then hitting the gym afterwards :-)

Maybe we could agree it depends on the individual on that one.

It is hitting close to home because I lost my husband to depression. Physical Health is critical but mental health would have to be number one in my books.

My husband was an avid skier and biker on top of regularly working out, even while he was going thru his depression, it didn’t make him better (maybe it helped a bit but focusing on his mental health could have been more beneficial).

My two cents worth:)

very sorry to hear that. i think the right way to think about it is as a risk factor. people who don’t get the minimum recommended exercise are more at risk of mental health issues, but it’s only one of many, many risk factors (genetics, social environment, personal trauma, nutrition, sleep, etc.)

Caroline I’m very sorry that you and your husband went through all of that. As a mental health epidemiologist – Kevin very accurately put how we look at physical activity (or lack thereof) and mental health. Lack of physical activity is a risk factor for depression, but there are plenty of people who engage in regular, vigorous physical activity who still experience depression. I want to give a shout out to MMM for mentioning running to the therapist or doctor! If you are experiencing depression, absolutely get out and get some fresh air, sunshine, and physical activity. And if that isn’t enough (and for many it helps but isn’t enough), then please seek additional treatment. There really are very effective treatments out there both in the form of therapy and medication that are available. The trick is finding the ones that work for you. (As well as ruling out other possible causes like thyroid problems, excessively low vitamin D, etc.).

Sorry for your loss, Caroline. Like your husband, I exercised regularly in my 20s, but still cried on the trail, in the cardio room while on machinery, in the weight room, during excercise classes, and in the pool. I believe that exercise is important for physical and mental health, but it’s NOT a cure-all.

MMM is correct here. When it comes to basic brain mechanics, and thus everything the brain begets (cognition, emotion, stress, mental health more generally, etc and so on), Exercise and Sleep are the two most powerful tools you’ve got at your disposal for brain health. Get those two right, and mental health will more easily follow.

This is why I’m proud to call myself a Mustachian, (even if I’m not overly enamoured with the term “Walrus”). This is not a cult, it’s just smarter thinking. People who call it so just don’t get it, which is fine. For them. Thanks Pete, for this blog, the forum and your astute rebuttal. I listened to PP’s interview the day it was released and had to turn away before the fifteen minute mark. It’s too bad that SO’s perspective is so warped that she can’t believe anyone with less that $5M can possibly eke out a happy, meaningful life, or end of life, for that matter. I’m happy to stick my fingers on my ears, wiggle my fingers and say, “la-la-la, I can’t hear you” when SO is speaking. Fortunately, I adhere to the MMM-backed low information diet. I never would have even listened to SO had she not appeared on a blog about living your best life, called “Afford Anything”. If nothing else, SO’s Poor Little Rich Girl blather made me even more grateful for what I have and for the existence of this community. Thanks, Pete!

I saw the Suze Orman interview and I’m so glad you debunked her thesis. This is the best post you’ve done in a while. I’ve worked in the financial services industry for over 25 years. I’m very familiar with Suze and her ilk. They have it backward for a reason. They put together financial plans that require millions of dollars in savings to finance your “Spending Need” because they get paid for “Assets Under Management”. In other words, they are not going to ever say, “Hey, if you stop spending so much, you could retire with a lot less savings” because its not in THEIR best interests. I discovered the MMM blog about 5 years ago, and it completely flipped my approach to clients 180 degrees. It’s a holistic, healthy, Earth friendly approach to use lower consumption as a means to become financially independent. I now delight in telling a prospect with modest spending needs that they will be fine. For 20 years I prepared financial plans requiring millions in savings. You and your fellow FIRE bloggers have broken a social construct that everyone should be very excited about – especially young people. Good work!

Great summary of FIRE. Orman has been making the rounds on financial podcasts as of late and every interview has been a cringeworthy mix of condescension and self admiration. She is clearly pandering to her base, but her base doesn’t usually listen to financial podcasts! Maybe next time podcasters can decide to decline her interview.

But Suze is 67 and has a personal jet. I’d be stupid to call it quits before I have that too, right?Especially the personal jet. My wife and I finished up a vacation in June where we went from southern Indiana to California. Had to see Yosemite. Our means of transportation had reclining seats, plenty of legroom and a great view of the scenery. We were able to see things on the way out to and back from Yosemite that would have otherwise passed under our wings had we used the personal jet that we don’t own. Of course we could have shaved a couple of days off that 29 day driving vacation.